How to build a tiny house

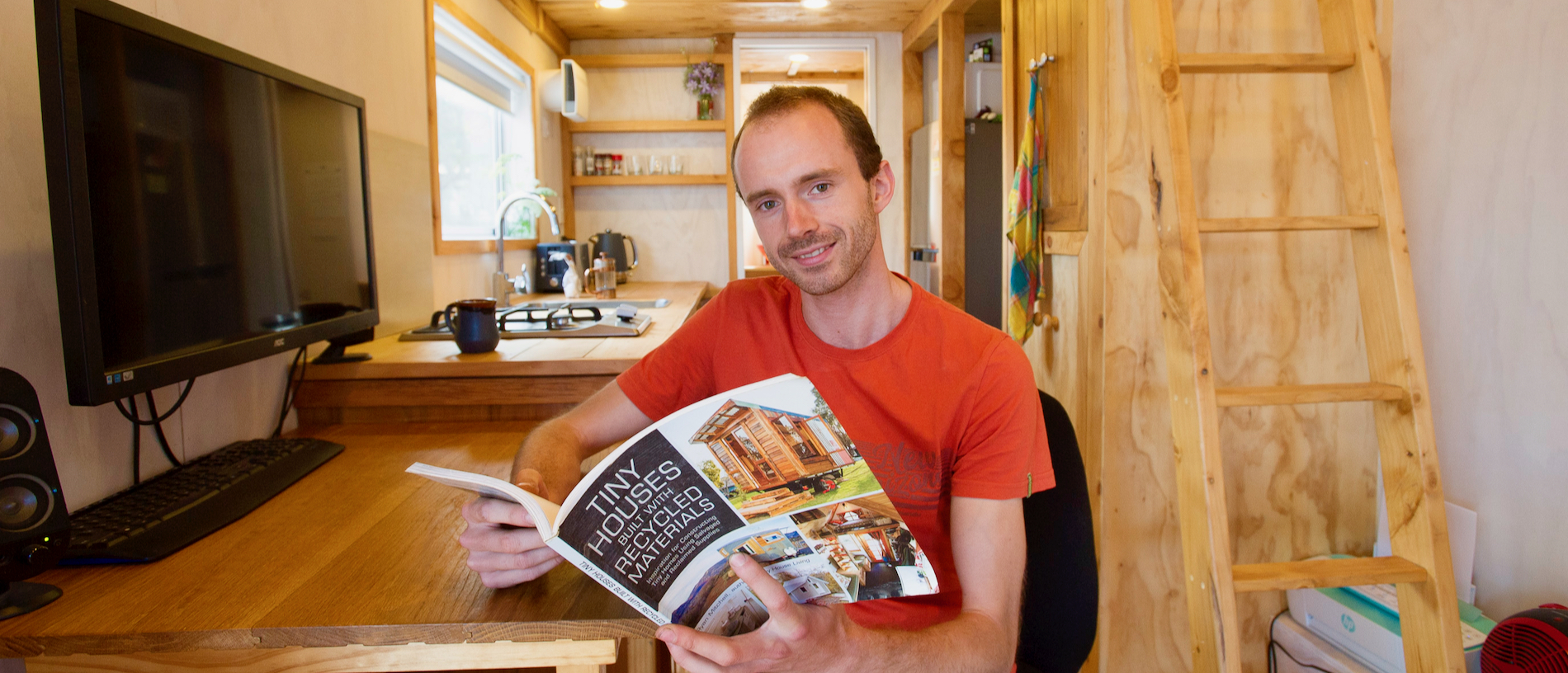

For Matthew Lillis, building a tiny house from scratch, on his own, was an opportunity to learn new skills.

The global pandemic may be subsiding, but the return of those pre-Covid halcyon days is still proving elusive.

Instead of bounding through 2023 with a skip in our stride, most New Zealanders are doing it tough – and even if you haven’t been directly impacted by this year’s extreme weather events, inflation and the skyrocketing cost of living has likely put the brakes on your post-pandemic exuberance.

According to recent data from Stats NZ, the cost of living for the average Kiwi household shot up by 8.2% from December 2021 to December 2022. That won’t come as a surprise to anyone tasked with the weekly grocery shop, as the price of food is leading the charge. Up a whopping 12.1% in the year to March, it’s the highest food inflation rate since 1989. Add to that the high cost of rent, and the gigantic increase in mortgage interest payments (up 38% in New Zealand’s highest-spending households) and it’s no wonder people are tightening their belts.

Can you really not enjoy your daily latte or splash out on the odd block of cheese? The only way to accurately answer these questions is to conduct a thorough and honest review of your finances. While many of us would rather watch paint dry than spend our downtime trawling through three months’ worth of bank statements, according to the experts, it’s the only way to get back into the financial driver’s seat.

Those bank statements will reveal a bunch of different things, but there’s only two you need to worry about: how much money is coming into the household (income) and how much is going out (spending). Spending less than you earn? Happy days! But if you’re spending more than you earn it could be time to channel Prime Minister Chris Hipkins and implement your very own ‘no frills’ budget. Sorted.co.nz has a great tool to make the process as painless as possible.

If things are getting tight, there are two ways you can tackle it – spend less, or earn more (or take a two-pronged approach for some turbo-charged traction). We caught up with personal finance whiz, writer Diana Clement, for a few budgeting tips. Here’s what she had to say.

“I think a lot of money saving comes down to being mindful. Do you really need that gadget you’re buying, or a haircut every six weeks? Why not try stretching it out by two or four weeks. The sky isn’t going to fall in.”

Whether you’re struggling to pay the bills, or just want to make sure you’re getting your money’s worth, Diana has some budgeting tips for everyone.

These are just a few ways we can make our hard earned dollars stretch a little further, but there are also a stack of great websites which help make the job easier.

Check out Keep the Change for funny, relatable, real-life lessons that’ll boost your money smarts, and go to Money Hub for a slew of guides, tools and free information. Dubbed ‘New Zealand’s Home of All Things Money’, this is your financial HQ for everything from loans, investing and insurance through to financial independence and better living.

Meanwhile, for free personalised help with budgeting and debt management check out Money Talks or for practical everyday tips join the Cheaper Living NZ Facebook group, where members motivate, encourage and challenge each other to save, reduce debt and live more economically.

Story by Vanessa Trethewey for the Winter 2023 issue of AA Directions magazine.